Introduction

2022 was tough for web3, with Bitcoin hitting $16,000 and projects like Celsius, Nuri, and FTX facing insolvency. This report shows their impact on 2022 hiring trends and predicts future trends (2023).

Companies Hiring

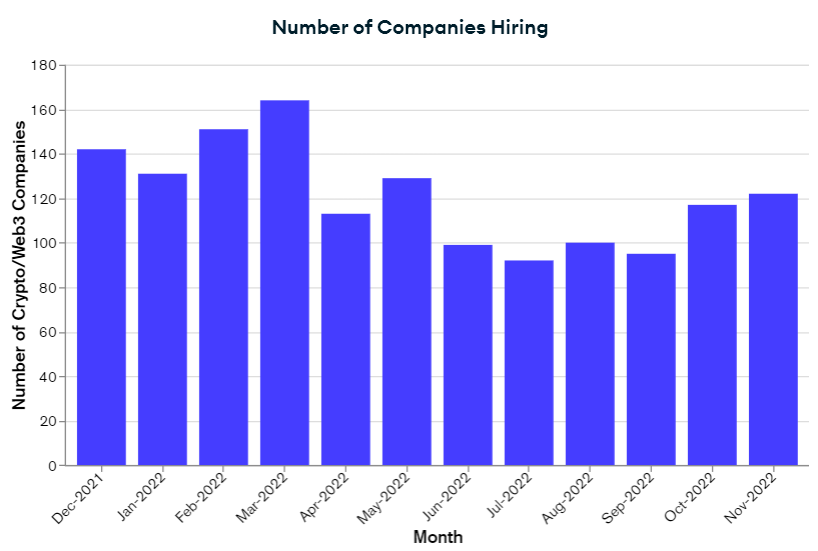

The chart below shows the number of companies hiring in the last 12 months. As we can see, this metric increased by 14% from December 2021 to March 2022 (Figure 1), showing any positive correlation with the bitcoin price: perhaps the advent of a bear market was not that clear to most companies since the Bitcoin price in March 2022 was still close to the $50k resistance (Figure 2). As the BTC price dropped more clearly (Figure 3), we witnessed a downtrend in the number of companies hiring, which went down by 44%: from 160/month in March to around 90/month in July.

Figure 1 - Source: Crypto Jobs List Trends

Figure 2 - Source: TradingView

Figure 3 - Source: TradingView

From July 2022 to December 2022 the trend looks upward and the number of companies hiring recovered by 33%.

The last 12 months’ bottom in the number of companies hiring overlaps with another major event which characterized the 2022 crypto jobs market: significant layoffs by some of the major crypto companies such as Coinbase, OpenSea and BlockFi, which cut roughly 20% of their staff.

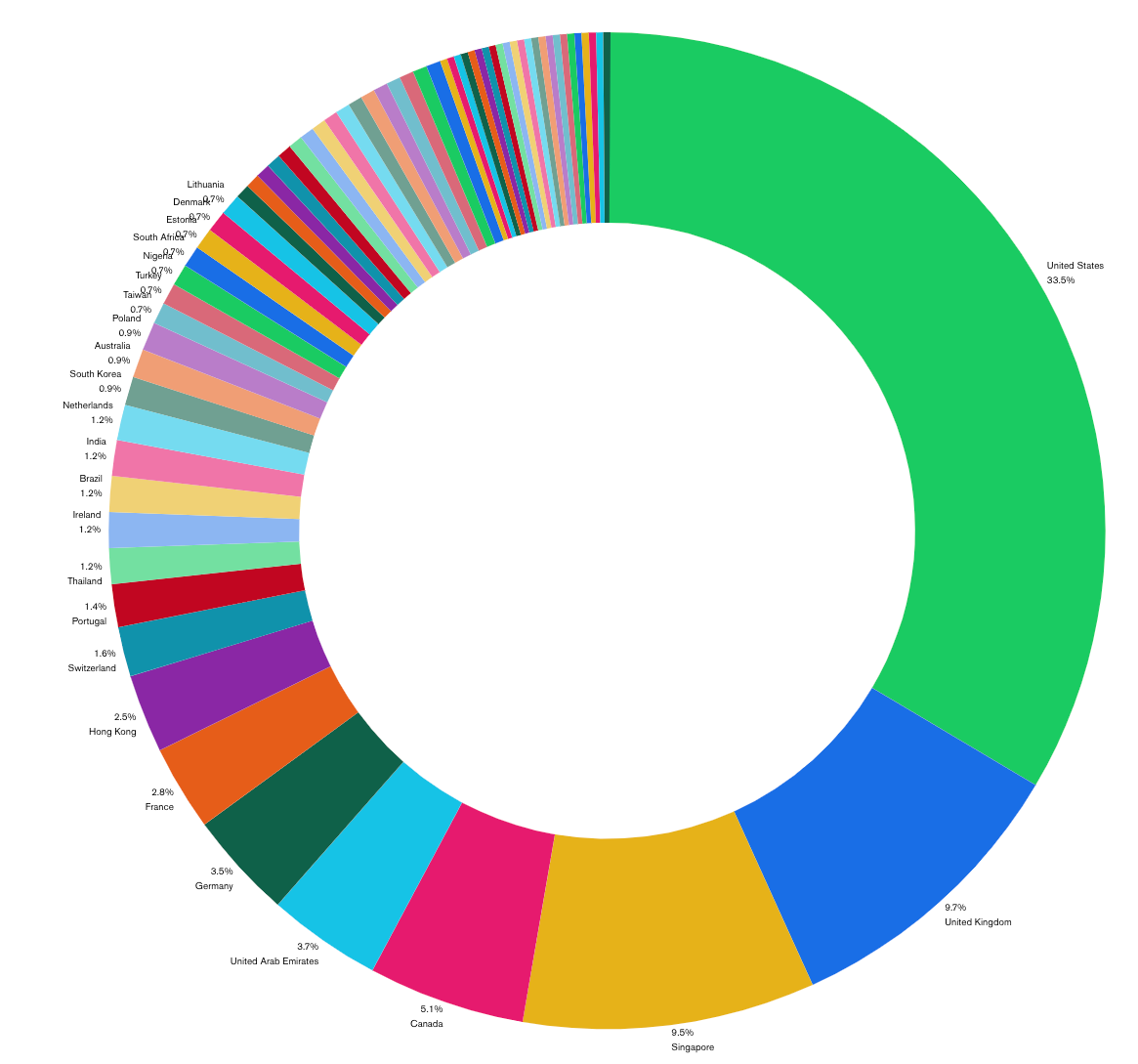

Companies by Country

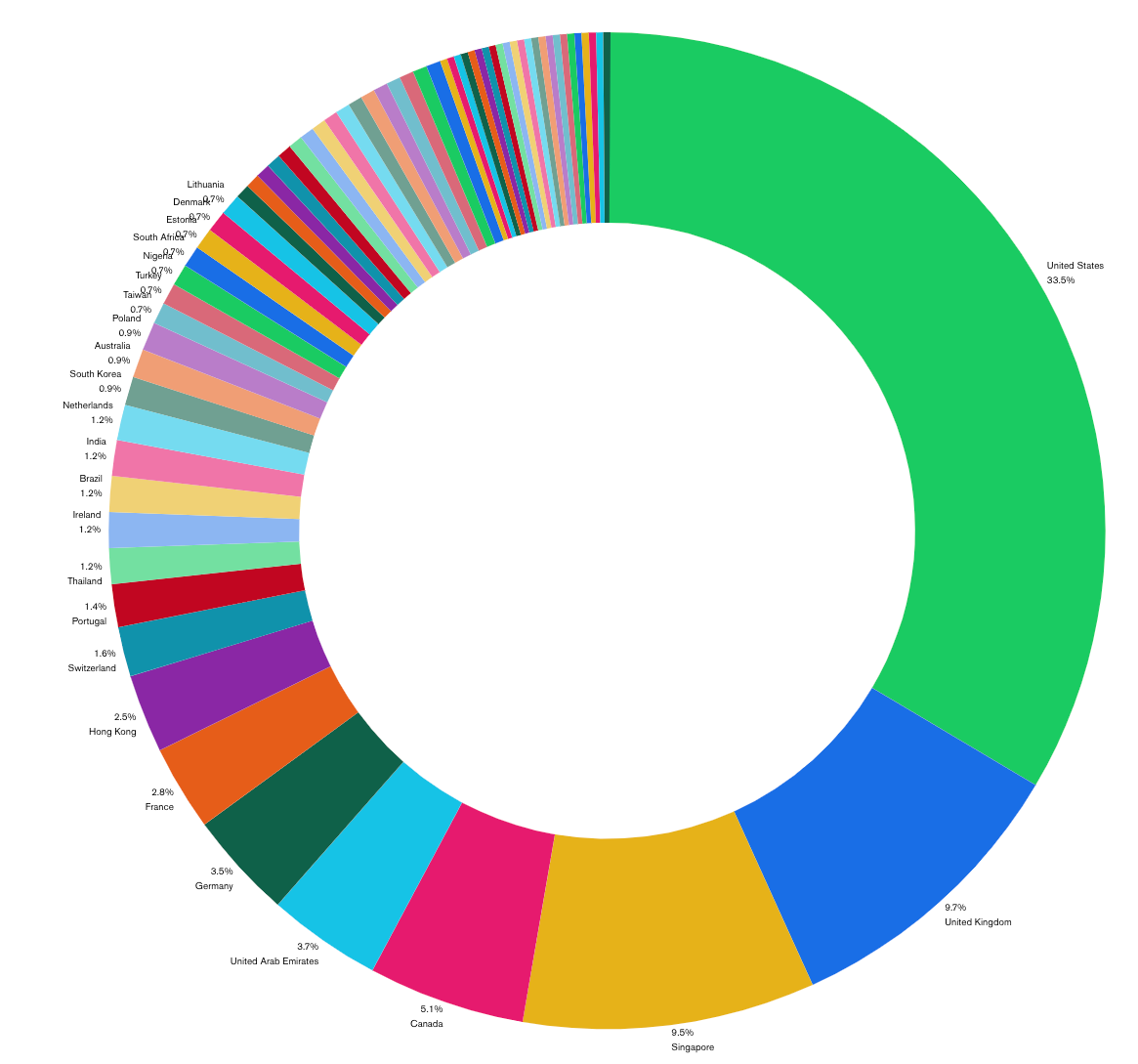

Companies that posted their vacancies on Crypto Jobs List were from the USA (33.5%) (Figure 4). The second most represented country was the United Kingdom (9.7%), followed by Singapore (9.5%), Canada (5.1%) and UAE (3.7%). The first country from UE appears in 6th place and it’s represented by Germany (3.5%).

Figure 4 - Source: Crypto Jobs List

| United States | 33.49% |

| United Kingdom | 9.70% |

| Singapore | 9.47% |

| Canada | 5.08% |

| United Arab Emirates | 3.70% |

| Germany | 3.46% |

| France | 2.77% |

| Hong Kong | 2.54% |

| Switzerland | 1.62% |

| Portugal | 1.39% |

| Brazil | 1.15% |

| India | 1.15% |

| Ireland | 1.15% |

| Netherlands | 1.15% |

| Thailand | 1.15% |

| Australia | 0.92% |

| Poland | 0.92% |

| South Korea | 0.92% |

| Denmark | 0.69% |

Job Posts

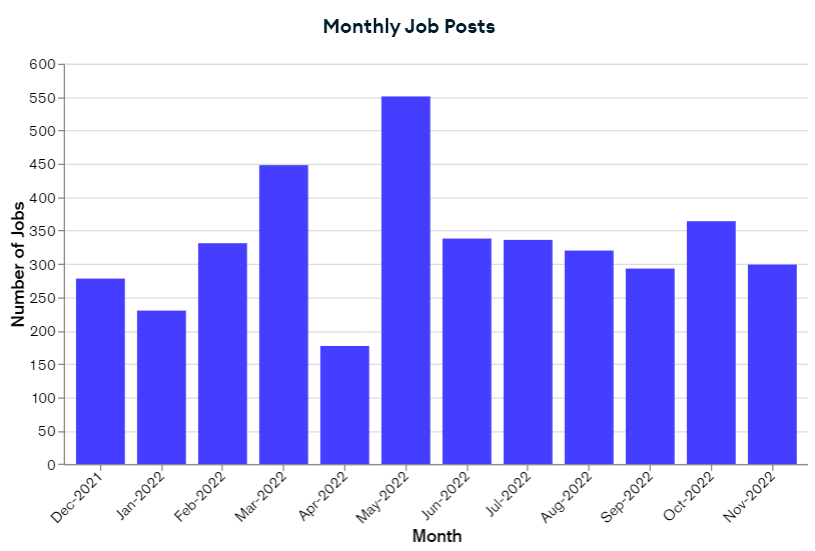

Figure 5 - Source: Crypto Jobs List Trends

Just like the number of companies hiring, the number of job posts increased from December 2021 to March 2022, dropped in April and recovered in May (Figure 5). The two metrics, in fact, have a certain degree of correlation: the more companies hire, the more job posts are published. In May, a small increase in the number of companies hiring led to a 70% increase in the number of job posts. It's hard to prove full cause-and-effect as some companies may increase hiring and job posts without requiring more firms to hire.

As the Bitcoin price plummeted in June and price action started moving sideways around the $20k level (Figure 3), the number of job posts remained pretty much steady.

Applicants

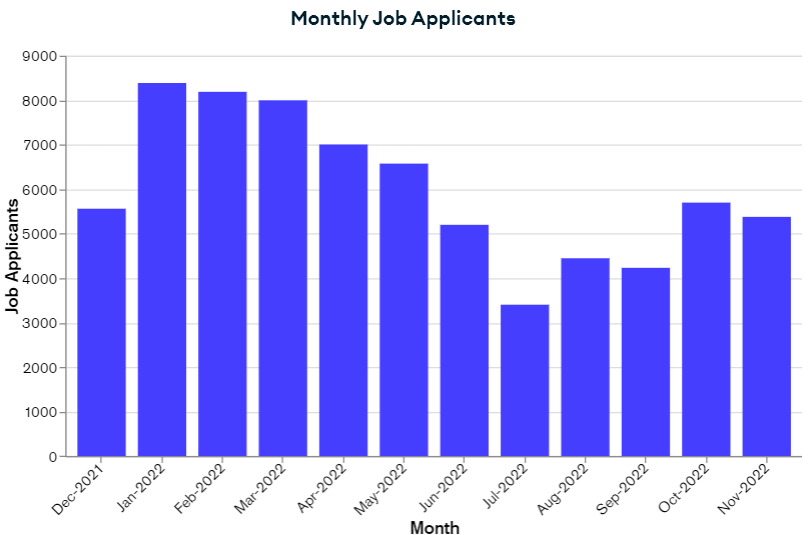

Figure 6 - Source: Crypto Jobs List Trends

Contrary to the number of companies hiring and monthly job posts, monthly job applicants decreased consistently from January to July (Figure 6). The bottom was reached in July, just like for the two previous metrics, and a shiny uptrend started taking shape from the month after. November 2022 saw job applicants return to December 2021 levels despite bear market, showing continued interest in cryptocurrency and web3 industry.

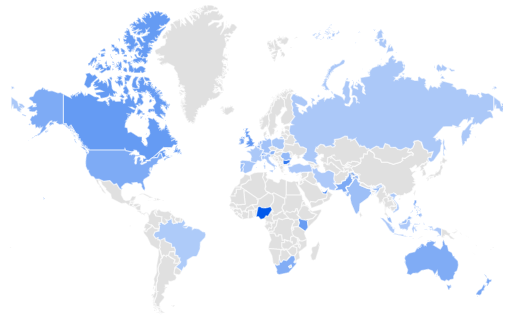

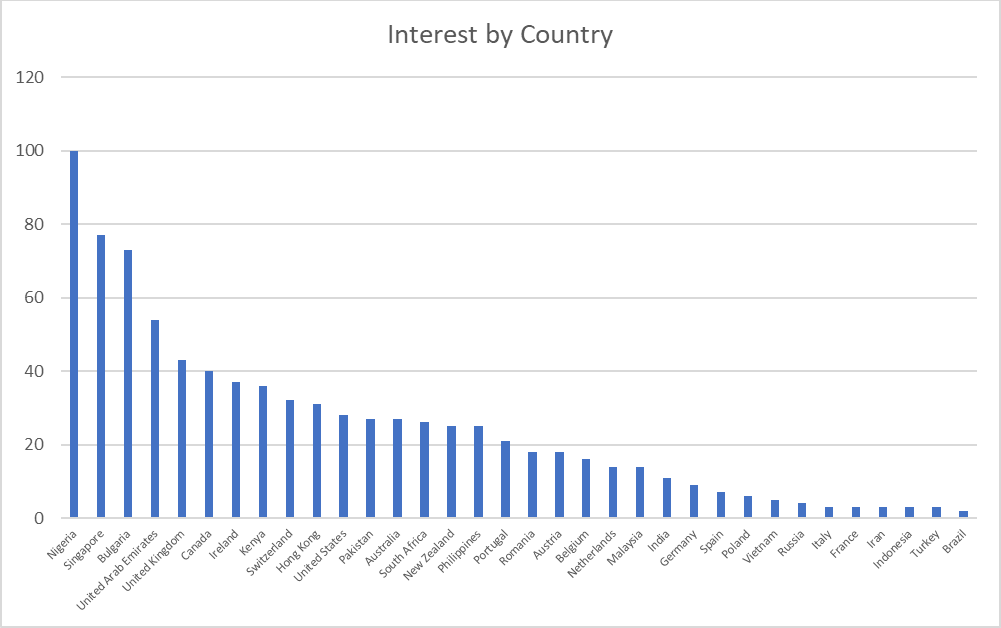

Interest by Country

We analyzed google search trends for the keyword “crypto jobs” to investigate the interest in crypto jobs around the world. The search intent behind this keyword is “browsing crypto job offers” and is indicative of the interest in finding a job in this industry. The results of the analysis are pretty interesting: the highest interest in crypto jobs comes from Nigeria; Singapore takes the second place while the United States are only eleventh (even behind Kenya which scores an eighth place). Two African countries are in the top ten and position themselves above developed countries such as the USA and Switzerland.

Figure 7 - Source: Google Trends

Figure 8 - Source: Google Trends

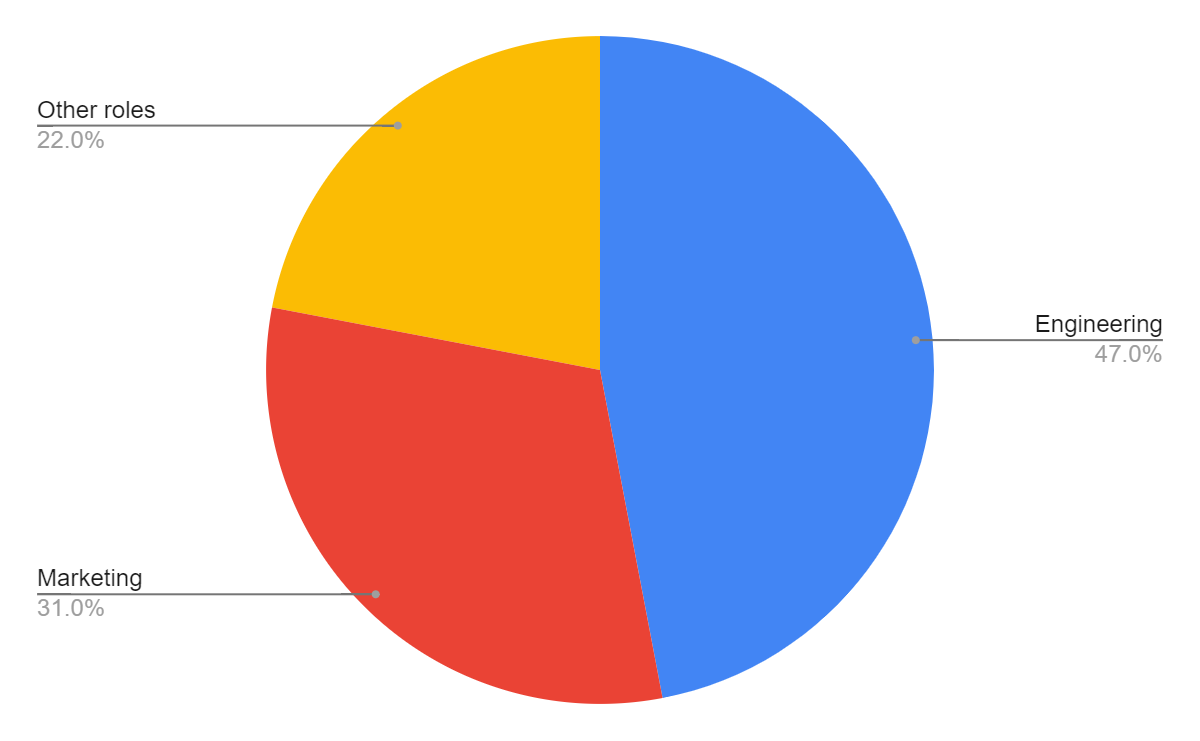

Most in-demand roles in 2022

The most in-demand job role in the industry in 2022 was the **Frontend Engineer **(14% of all vacancies). It was followed by the **Community Manager **(8%) and the **Product Manager **(7%). Overall, engineering roles were the ones which appeared most frequently among job offers (47% of all vacancies), followed by marketing roles (31%). The least in-demand positions were compliance roles (3.5%).

Figure 9 - Source: Crypto Jobs List

| 1. frontend engineer |

| 2. community manager |

| 3. product manager |

| 4. full stack engineer |

| 5. solidity engineer |

| 6. blockchain engineer |

| 7. product designer |

| 8. backend engineer |

| 9. devops engineer |

| 10. software engineer |

| 11. social media manager |

| 12. data engineer |

| 13. marketing manager |

| 14. chief marketing officer |

| 15. content writer |

| 16. head of marketing |

| 17. smart contract engineer |

| 18. business development manager |

| 19. project manager |

Most Popular Tags (job categories)

The most frequent job tag in 2022 was “full-time”, demonstrating that most employers look for candidates who can fully commit to the project. The second most frequent tag was “remote”, aligned to the new working trend which was boosted by COVID. “Developer” was the 3rd most popular tag, which is not a surprise since we already saw that the Frontend Engineer was the most in-demand job role and that 47% of all vacancies were engineering positions.

Figure 10 - Source: Crypto Jobs List

| 1. full-time | 6. engineering | 11. manager | 16. content |

| 2. remote | 7. web3 | 12. marketing | 17. trading |

| 3. developer | 8. community | 13. legal | 18. senior |

| 4. data | 9. finance | 14. NFT | 19. security |

| 5. defi | 10. research | 15. operations | 20. compliance |

Salaries - Most paid crypto jobs in 2022

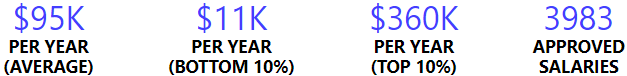

Most paid jobs in 2022 were found within the niche of NFT jobs, with top 10% salaries reaching $360,000/year (Figure 11).

Figure 11 - Source: NFT Salary

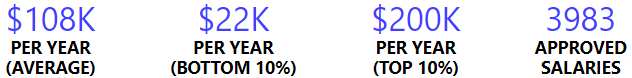

Solidity positions represented the second most paid jobs (Figure 12), with salaries reaching $200k/year. We noticed that on average NFT jobs were paid less than Solidity jobs and the bottom 10% salaries were even 50% lower.

Figure 12 - Source: Solidity Salary

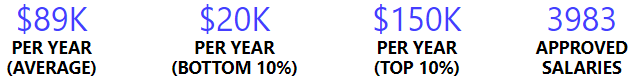

Blockchain Developer salaries took the 3rd place, reaching $150k/year (top 10% salaries) (Figure 13). Also in this case, the average is higher than the one of NFT jobs but lower than the average salary of Solidity Jobs.

Figure 13 - Source: Developer Salary

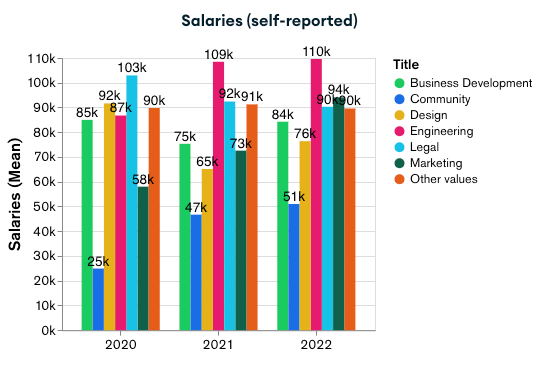

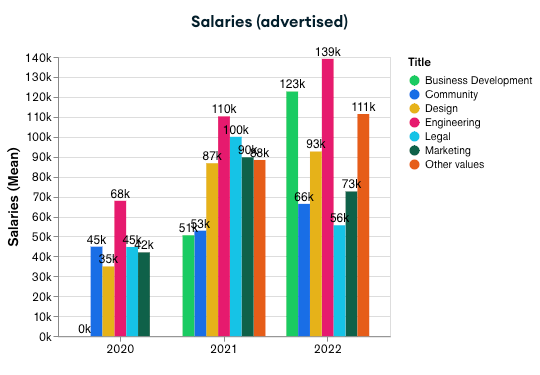

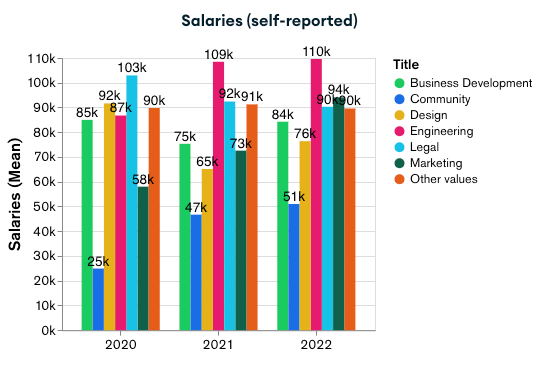

Looking at companies’ functions instead (Figure 14), we see that top paid jobs were found within the engineering function in 2022 ($110k/year on average). Marketing roles follow, with an average salary of $94k/year (17% lower than engineering). Legal roles take the third place and score a $90k/year average (only 4.4% lower than marketing and 22% lower than engineering).

Figure 14 - Source: Crypto Jobs List

Figure 15 - Source: Crypto Jobs List

Discrepancies between self-reported and advertised salaries (*Figure 14, Figure 15) may reflect poor negotiation skills or mismatched expectations for community roles, which are higher in advertised salaries, indicating bad negotiation or poor profiles.

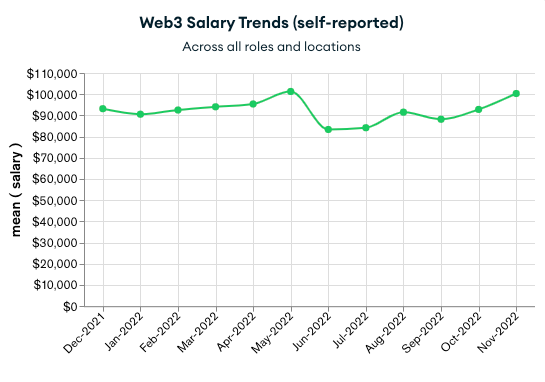

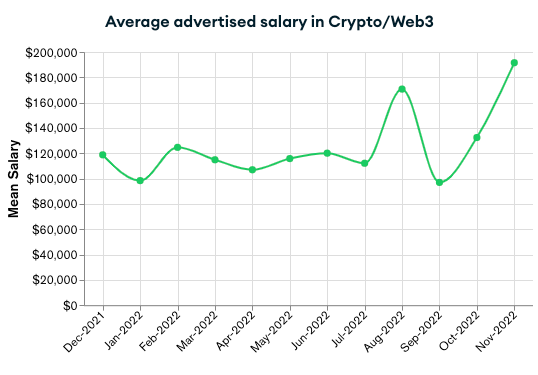

Looking at overall salary trends (Figure 16 and 17), in the last twelve months self-reported salaries moved sideways between the $80,000/year and the $100,000/year range, ending the year with a slightly higher average than in December 2021 (Figure 16). Advertised salaries instead, showed a clearer uptrend and increased by 58% from December 2021 to the end of 2022 (Figure 17). This big increase in advertised salaries was not reflected in self-reported salaries and we can notice significant discrepancies between the two metrics which do not coincide at any point in time. This could be interpreted as a sign that companies tend to advertise higher salaries than what they actually offer, probably to make job posts more appealing for candidates.

Figure 16 - Source: Crypto Jobs List

Figure 17 - Source: Crypto Jobs List

Events that had the biggest impact on the hiring

In the chapter “Companies hiring” we mentioned the beginning of the Bitcoin bear market as one of the major events which impacted hiring. During the month of June, in fact, we witnessed a sharp correction in the BTC price which brought its market value to $20,000. As shown in Figure 1, during the months of June and July, the number of companies hiring reached the lowest levels of the year. During the same period, we witnessed major layoffs which we’ll analyze more in detail in the next chapter.

A second event which negatively impacted hiring is surely represented by the liquidity crisis caused by the collapse of Luna and TerraUSD in May. This crisis affected several companies in 2022, starting with Celsius, Voyager Digital and Nuri.

On June 12th, Celsius filed for bankruptcy, and during the court hearing, the crypto lender's lawyer said roughly 170 employees were left, down from 370 before.

On July 6th, Voyager Digital filed Chapter 11 in the wake of Celsius. It was employing 231 people.

Nuri filed for insolvency on August 9th, only two months after Celsius. Later in October it collapsed, failing to find an acquirer. It had 215 employees who now lost their jobs.

More recently, the insolvency crisis touched another series of companies as a consequence of the FTX collapse, which declared bankruptcy on November 11th. It was employing more than 300 professionals.

BlockFi was the first company to follow FTX and filed Chapter 11 only a few weeks after the latter. It had 674 employees.

Many other companies accused the impact of FTX, but it’s likely that we’ll see the complete effects of this second liquidity crisis only a few months after the FTX collapse date.

For now, we witnessed a withdrawal freeze by Genesis but no official bankruptcy yet. We may consider its 97 employees at risk.

Major Layoffs

As we anticipated in the chapter “Companies hiring”, the months of June and July 2022 were characterized by significant layoffs. In that period, the following companies cut between 5% and 45% of their staff:

Gemini

On June 2nd, the company announced that it would be cutting approximately 10% of its staff because of the turbulent market conditions.

Coinbase

On June 14th, Coinbase announced the need to lay off 1,100 of its employees (18% of its staff) and prepare for an extended bear market.

Crypto.com

On June 10th, Crypto.com’s CEO stated on Twitter that they would cut 5% of their staff (or 260** **workers) in order to ensure sustainable growth.

2TM

During the same week, the company behind Mercato Bitcoin (the second-largest exchange in Latin America) stated that it would lay off 12% of its 750 employees because of major changes in the global financial landscape.

Bitso

Only a week before, the largest exchange in Latin America revealed that it was laying off 80 of its 700 employees.

Bitpanda

Bitpanda, a popular platform for trading digital assets, stocks and commodities, stated on June 24th that it was going to fire 270 of its workers.

Banxa

Banxa, an Australian crypto firm, announced on June 27th that it would be cutting staff by 30%, reducing the company’s headcount to 160 workers from 230.

Compass Mining

On July 7th, the bitcoin mining business announced that it would lay off 15% of its employees. The company was founded last year and had 78 employees listed on its website at the time of the announcement.

OpenSea

In mid-July, the leading NFT marketplace announced the need to lay off 20% of its staff. According to an internal Slack message shared by the company CEO on Twitter, OpenSea will help workers let go with job placement resources and generous severance.

Blockchain.com

In late July, Blockchain.com announced that it was cutting its staff by 15% (or 150 employees). The majority of the job cuts took place in Argentina but also some employees in the UK and US lost their jobs.

Swyftx

Swyftx, a popular Australian exchange, laid off 21% of its employees on August 17. The company cited the crypto bear market as justification for firing 74 of its workers.

Emerging job roles

NFT

2022 was characterized by the presence of several NFT job offers. As we saw in the chapter “Most paid crypto jobs in 2022”, NFT jobs scored the highest salaries among crypto jobs. In this chapter, we’re going to see what were the most in-demand NFT jobs in 2022 and what skills were the most requested by NFT companies.

The first piece of information from our data analysis which surely deserves attention is that the top two most in-demand job roles in NFTs are not a developer position, contrary to what one might intuitively think. The number one most in-demand job role in NFTs is, in fact, the** Business Developer** (17% of all job offers in NFTs), followed by the Marketing Manager (13%). The third most researched professional is finally a developer profile, the** Full Stack Software Engineer,** which represents the 10% of all job offers in NFTs.

Overall, job roles in NFTs are equally distributed between business/marketing roles (45%) and development/product roles (45%). Legal/compliance jobs represent a marginal portion of all job offers in this industry (10%).

While there is no guarantee that these distributions will remain unchanged, at this time business development professionals, marketing managers and full stack developers know their profile can be attractive to companies in the NFT space. But if they come from Web2 and want to find a Web3 job, they must be ready to demonstrate to be knowledgeable about the latter.

The most required skill for full stack developers in NFTs is developing using React,js (a popular frontend development library), followed by TypeScript. As for business roles, it’s usually required a good non-technical knowledge of NFTs, which can be demonstrated for example through an “on-chain resume” (your crypto wallet on-chain activity associated with minting and trading NFTs).

Rust jobs

In June 2021, Solana raised a $314 million funding round and since then its popularity increased. In 2022, it had more than 300 open positions on its careers page and many other projects based on Solana kept on hiring. This led to an increase in Rust jobs, engineering roles which require mastering the Rust programming language. As reported on Solana website’s careers page, a Rust developer with only 3 years of experience can aim at a minimum salary of $85,000/year and a maximum of $125,000/year.

Community Managers

Despite the key role that Community Managers play within any web3 project, in 2022 they’re still underrated. The chart below shows, in fact, that they represent the least paid job role in crypto (just like in 2020 and 2021). However, we notice that their salaries kept on growing during the last three years and doubled from 2020.

Figure 18 - Source: Crypto Jobs List

Metaverse Architects

NFTs became extremely popular during the last bull run and in late 2021 Meta Platforms Inc. published its Metaverse Keynote. The combination of these two major events led to the proliferation of a new class of professionals: the Metaverse Architects.

Metaverse Architects are responsible for designing virtual spaces in virtual worlds such as Decentraland and The Sandbox. They’re able to imagine large structures which reach beyond the limitations of physics and therefore they need to be creative above all else. On the technical side, Metaverse Architects are required to master **Blender **and UV. They should also be familiar with 3D software like Sketch up, Vray, Zbrush, Cinema 4D, 3DS Max or Maya.

A popular Metaverse Architecture studio is Voxel Architects, which completed 100+ projects on Decentraland and SandBox. Its CEO, George Corneliu Bileca, gives us a hint on how much a Metaverse Architect studio can actually earn: “a digital asset in the Metaverse can cost as much as an actual architecture company. Voxel can handle 4 projects/month for between $10,000 and $300,000"

MEV / Flashbots specialized teams are being formed

Miners are those entities which control the inclusion, the exclusion and the ordering of transactions in a blockchain. The value that miners can obtain from changing the order of the transactions is called “miner extractable value” (MEV).

To better understand how MEV works, let’s take an example of an arbitrage transaction on DEXs:

Automated market makers, a particular type of DEX, let users buy and sell cryptocurrencies without the involvement of third parties. AMMs are unaware of the coins’s current market price and depend on arbitrageurs to return the coins’ price to the market price. This way, arbitrageurs make sure that DEXs have fair prices. The settlement mechanism of decentralized ledgers allows orders to be exposed before they are settled, allowing any miner to trade ahead of profitable trading opportunities presented for settlement by the arbitrageurs.

Arbitrage is considered as MEV only when a miner replaces someone else's transaction with his own, or changes the order of transactions for a priority tip.

So far we’ve only witnessed the formation of small, hyper-specialized teams on Twitter that take advantage of MEV, but no formal job posts yet. However, this could be a new hiring trend for 2023 and upcoming years.

To conclude...

Thanks for reading until the end. This is our first annual job report, so if you feel we should include more metrics and insights, please don’t hesitate to contact us on Twitter or over email: support at cryptojobslist.com. Thanks!

PDF Version is available here: 2022 Crypto & Web3 Jobs Report PDF